Capital Gains Tax Rate 2024 Philippines Calculator. Use the latest tax calculator to manage your 2024 tax obligations in the philippines. Capital gains tax in the philippines is levied at a rate of 15% on real estate and stock sales.

Capital gains tax in the philippines is levied at a rate of 15% on real estate and stock sales. Taxable income is the portion of an individual’s or corporation’s income used to calculate how much tax they owe to the government in a specific tax period.

Capital Gains Tax Rate 2024 Philippines Calculator Images References :

Source: verenawjoly.pages.dev

Source: verenawjoly.pages.dev

2024 Lunar Calendar Philippines Capital Gains Tax Rasia Catherin, The rate is 6% capital gains tax based on the higher.

Source: fedorableoine.pages.dev

Source: fedorableoine.pages.dev

Capital Gains Tax Rate 2024 Philippines 2024 Britt Colleen, Cherry vi saldua castillo / july 17, 2022 / real estate taxes and fees / 187 comments.

Source: www.financestrategists.com

Source: www.financestrategists.com

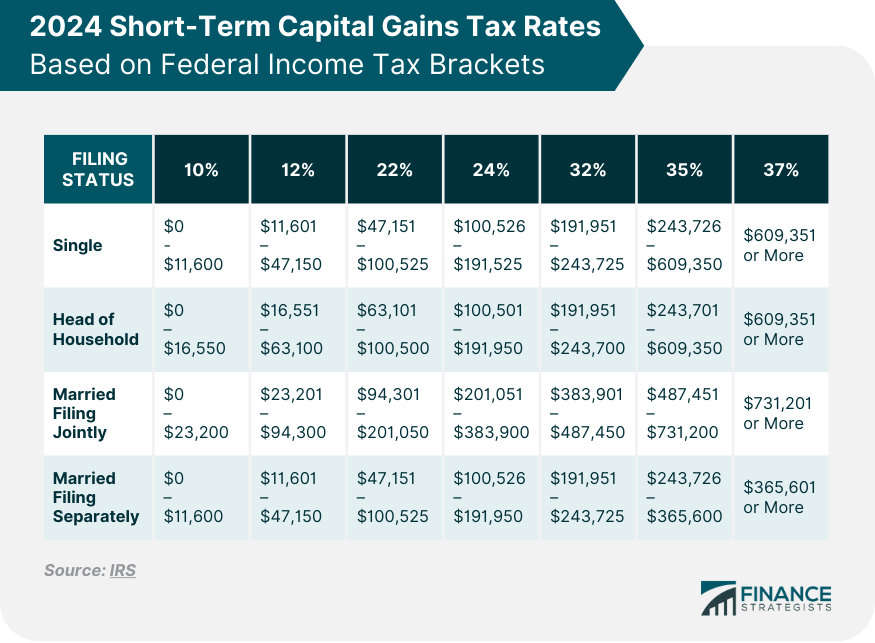

Capital Gains Tax Rate 2024 Overview and Calculation, This tax is imposed on the gains that have presumed to be realized by the seller from the exchange and sale or the disposition of any other capital assets.

Source: www.philippinetaxationguro.com

Source: www.philippinetaxationguro.com

Capital Gains Tax How it Works and What You Need to Know TAXGURO, Capital gains tax in the philippines is levied at a rate of 15% on real estate and stock sales.

Source: realwealth.com

Source: realwealth.com

How to Calculate Capital Gains Tax on Real Estate Investment Property, Capital gains tax calculator accurately works out your cgt on shares, property & investments.

Source: www.financestrategists.com

Source: www.financestrategists.com

Capital Gains Tax Rate 2024 Overview and Calculation, You’ll pay 15 percent on capital gains if your income ranges from $44,626 to $492,300.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

ShortTerm And LongTerm Capital Gains Tax Rates By, You may owe capital gains taxes if you sold stocks, real estate or other investments.

Source: www.businessinsider.in

Source: www.businessinsider.in

Capital gains tax rates How to calculate them and tips on how to, This tax is imposed on the gains that have presumed to be realized by the seller from the exchange and sale or the disposition of any other capital assets.

Source: thenewsintel.com

Source: thenewsintel.com

ShortTerm And LongTerm Capital Gains Tax Rates By The News Intel, The capital gains tax rate is 6% and is calculated based on the higher of the gross selling price or the current fair market value.

Source: deeydiannne.pages.dev

Source: deeydiannne.pages.dev

Short Term Capital Gains Tax Rates 2024 Brigid Carolyn, Taxable income is the portion of an individual's or corporation's income used to calculate how much tax they owe to the government in a specific tax period.

Category: 2024