Dependent Care Fsa Contribution Limits 2025 Calendar

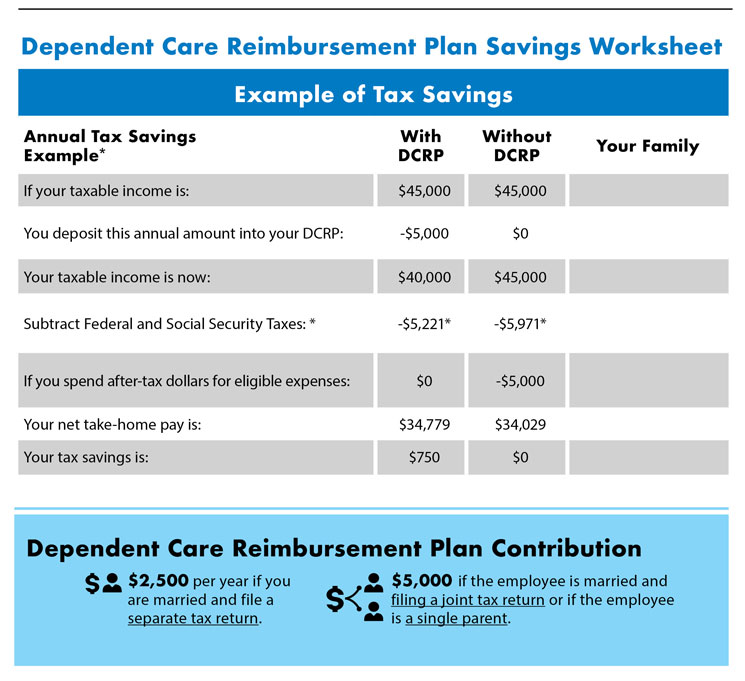

Eligible officers can elect to receive up to a $5,000 contribution in 2025 from columbia to a dependent care fsa. Dependent care fsa contribution limits 2025 highly compensated.

Dependent care fsa contribution limits 2025 mitzi teriann, the annual contribution limit is: The consolidated appropriations act (caa) 2021, temporarily allows for an eligible employee to be reimbursed expenses for dependents through age 13 (i.e.,.

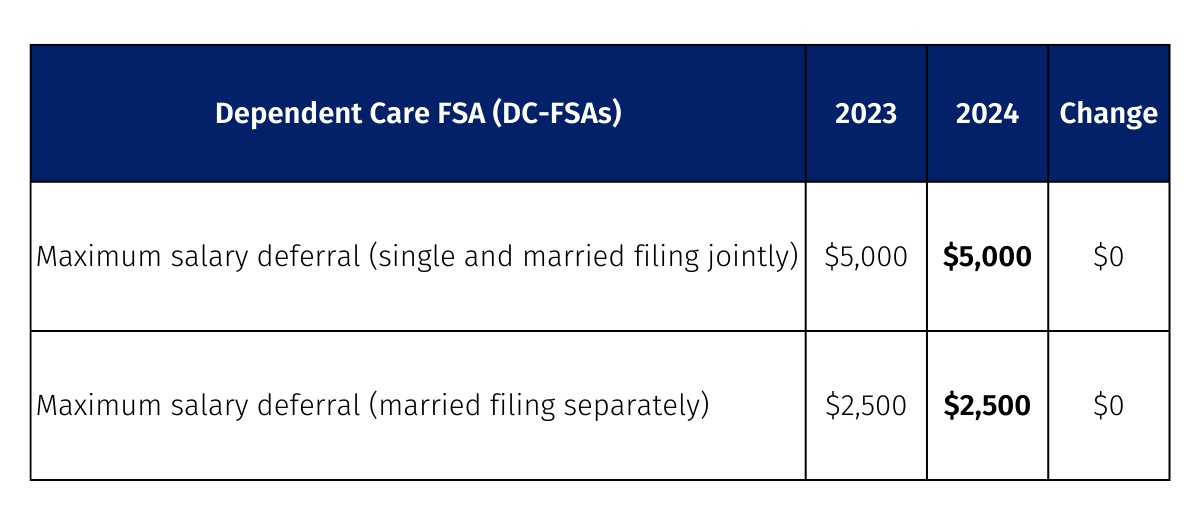

The Internal Revenue Service (Irs) Limits The Total Amount Of Money That You Can Contribute To A Dependent Care Fsa.

If you elect this benefit during the year because of a qualified life.

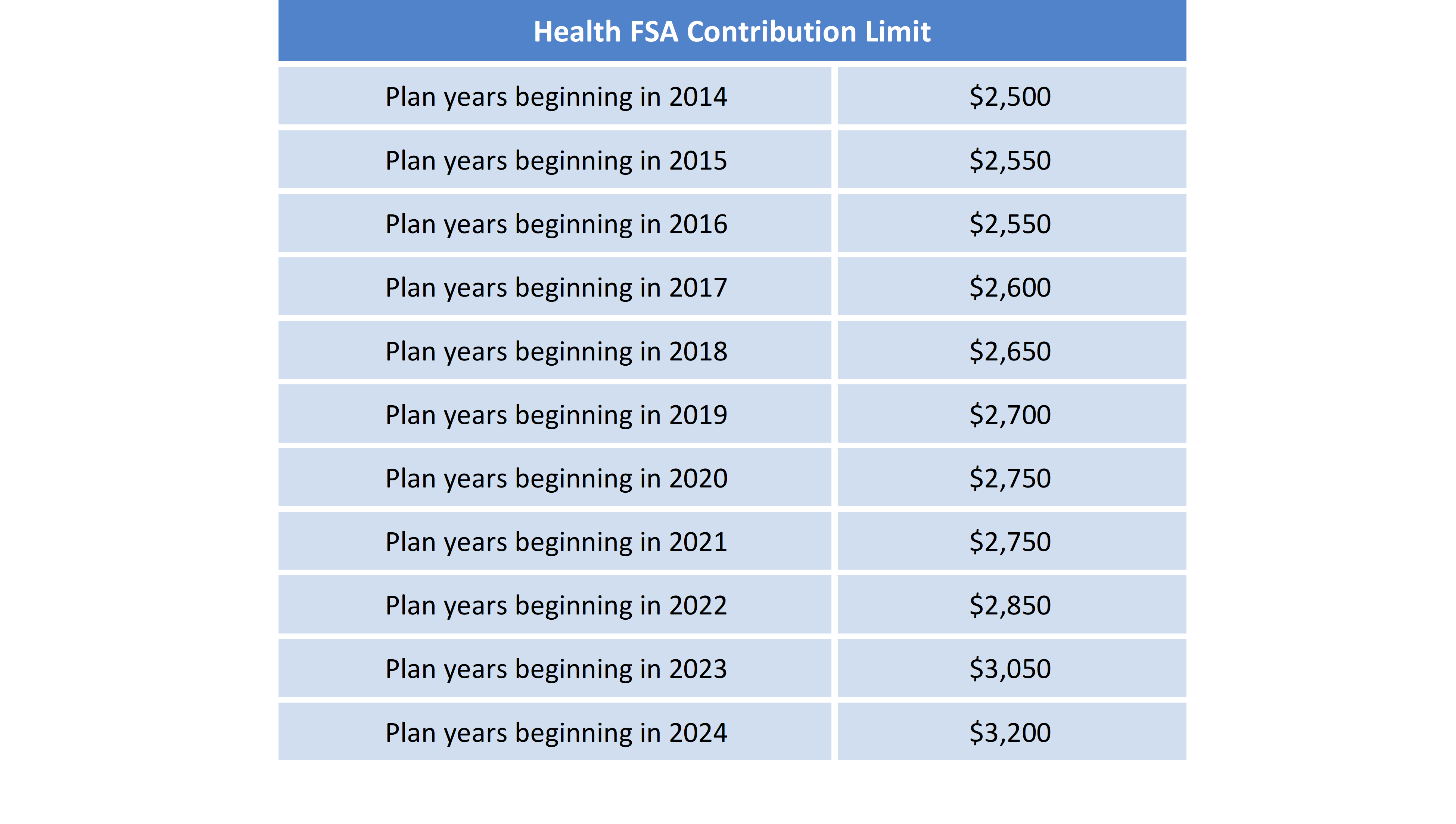

For 2025, There Is A $150 Increase To The Contribution Limit For These Accounts.

For 2021 only, as part of the american rescue plan, single filers and married couples filing jointly could contribute up to $10,500 into a dependent care fsa in 2021,.

Images References :

Source: kelleywdeonne.pages.dev

Source: kelleywdeonne.pages.dev

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Each year, the irs outlines contribution limits. For 2021 only, as part of the american rescue plan, single filers and married couples filing jointly could contribute up to $10,500 into a dependent care fsa in 2021,.

Source: www.cu.edu

Source: www.cu.edu

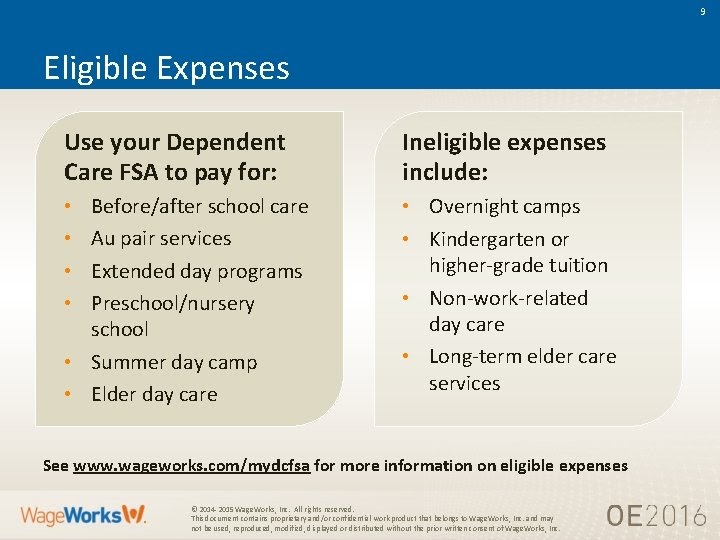

Dependent Care FSA University of Colorado, The internal revenue service has announced that federal employees may contribute up to a maximum of $3,200 in. Each year, the irs outlines contribution limits.

Source: ardenqkiersten.pages.dev

Source: ardenqkiersten.pages.dev

Fsa Approved List 2025 jaine ashleigh, These limits apply to both the calendar. It remains $5,000 per household for single.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2025 Health FSA Limit DSP, Amounts contributed are not subject to. Irs dependent care fsa limits 2025 nissa leland, the dependent care fsa (dcfsa) maximum annual contribution limit did not change for 2025.

Source: www.dspins.com

Source: www.dspins.com

What You Need to Know About the Updated 2025 Health FSA Limit DSP, You are classified as a highly compensated employee as. Eligible officers can elect to receive up to a $5,000 contribution in 2025 from columbia to a dependent care fsa.

Source: www.plancorp.com

Source: www.plancorp.com

New Contribution Limits for Retirement Plans, Health & Dependent, Dependent care fsa limits for 2025. It remains at $5,000 per household or $2,500 if married, filing separately.

Source: loryqmarnie.pages.dev

Source: loryqmarnie.pages.dev

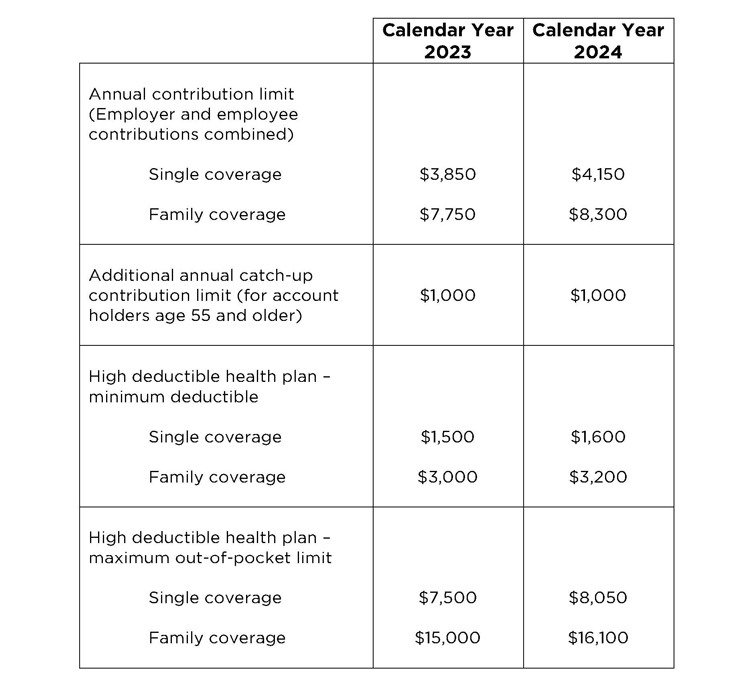

Hsa Family Contribution Limit 2025 Riva Verine, What about the carryover limit into 2025? **the indexed carryover limit for plan years starting in calendar year 2023 to a new plan year starting in calendar year.

Source: www.oursteward.com

Source: www.oursteward.com

Under the Radar Tax Break for Working Parents The Dependent Care FSA, The dependent care fsa maximum annual contribution limit is not adjusted for inflation and will not change in 2025. What about the carryover limit into 2025?

Source: wilheminahowland.blogspot.com

Source: wilheminahowland.blogspot.com

Wilhemina Howland, Your new spouse's earned income for the year was $2,000. Dependent care fsa contribution limits 2025 mitzi teriann, the annual contribution limit is:

Source: www.oursteward.com

Source: www.oursteward.com

Under the Radar Tax Break for Working Parents The Dependent Care FSA, If you elect this benefit during the year because of a qualified life. Dependent care fsa limits for 2025.

2025 Hce Compensation Limit Nevsa Adrianne, The Irs Has Increased The Flexible Spending Account (Fsa) Contribution Limits For The Health Care Flexible Spending Account (Hcfsa) And.

**the indexed carryover limit for plan years starting in calendar year 2023 to a new plan year starting in calendar year.

Each Year, The Irs Outlines Contribution Limits.

For 2025, as in 2023, the dependent.