Mileage Reimbursement 2024 Electric Vehicle. At mileiq, we frequently get asked, “is mileage reimbursement different for electric vehicles? Beginning on january 1, 2023, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be:

The automobile allowance rates for 2024 are: Beginning on january 1, the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable,.

Below We’ll Break Down How Tracking Business.

The irs optional standard mileage reimbursement rate will increase to 67 cents per mile driven for business use, which is.

Irs Issues Standard Mileage Rates For 2024;

At mileiq, we frequently get asked, “is mileage reimbursement different for electric vehicles?

Our Response — Yes And No!

Images References :

Source: www.workyard.com

Source: www.workyard.com

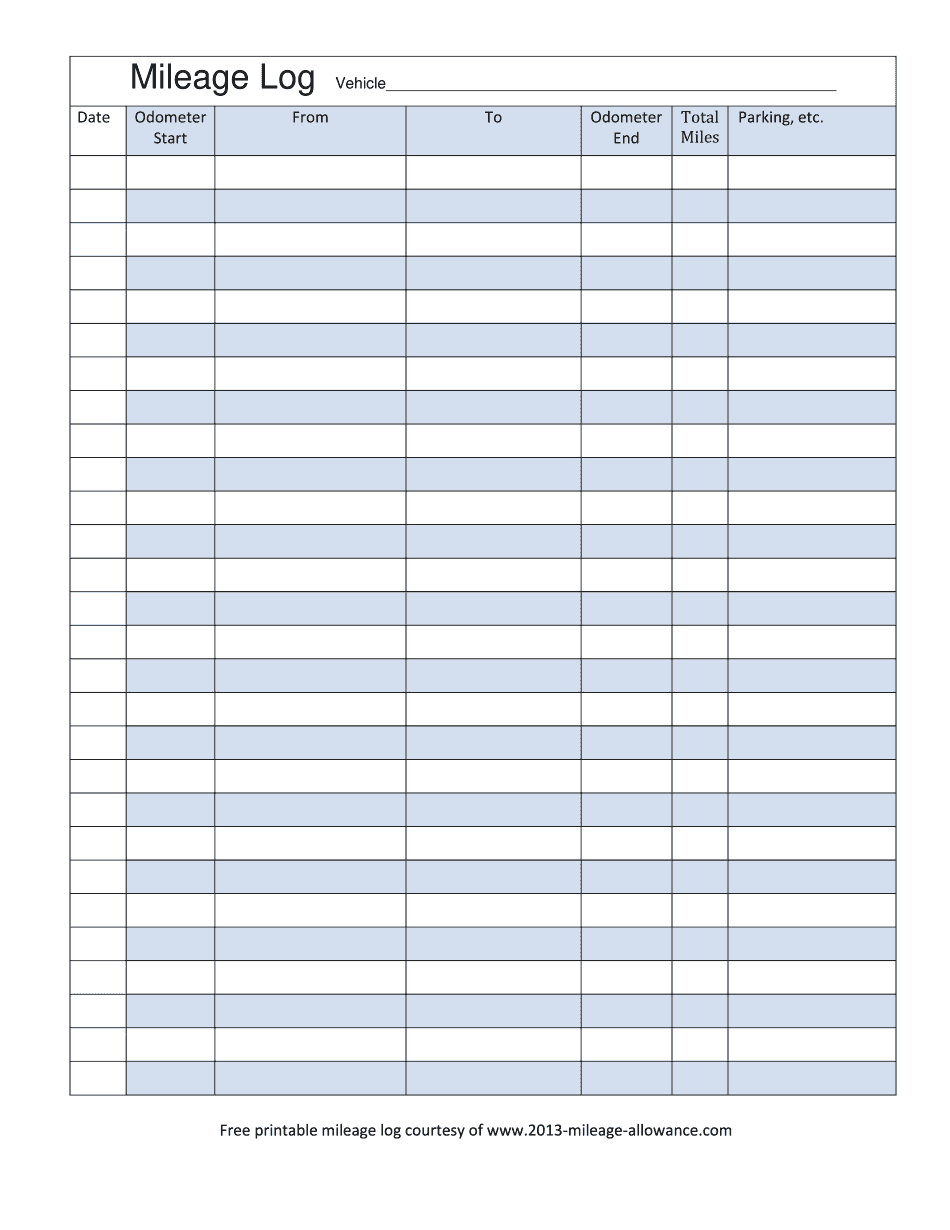

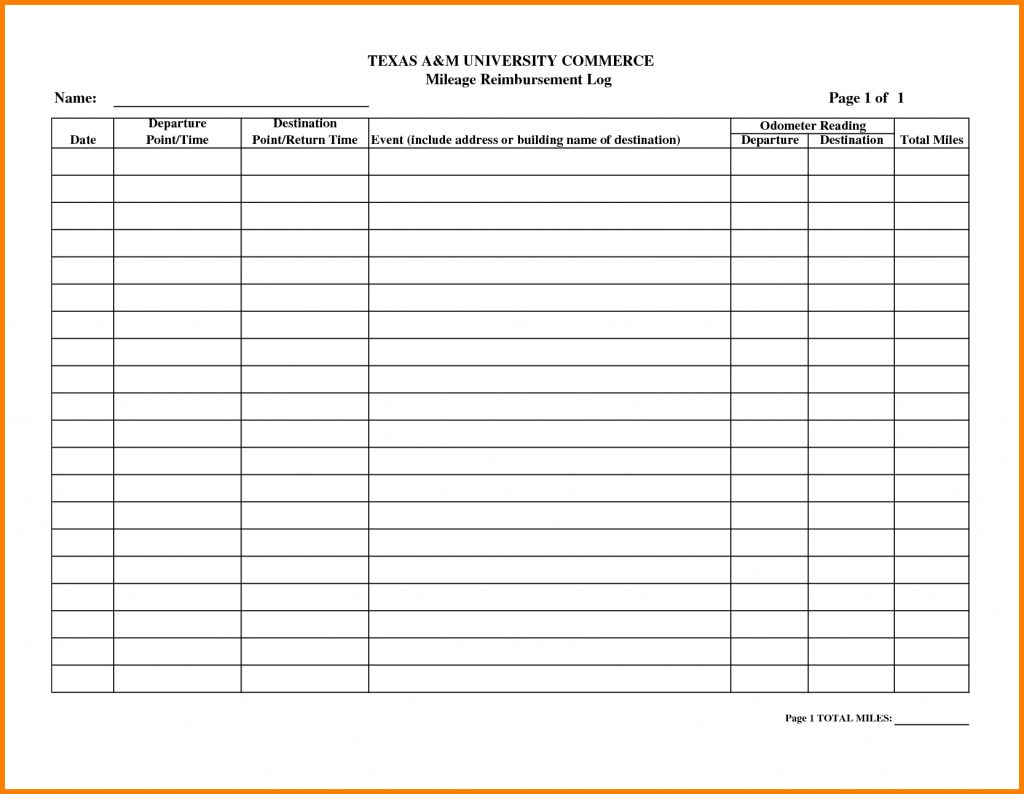

Free Mileage Reimbursement Form Download and Print!, White house softens ev mileage rule in a win for automakers. In this guide we'll cover:

Source: caboolenterprise.com

Source: caboolenterprise.com

Mileage Reimbursement Form in PDF (Basic) / Mileage Reimbursement Form, Irs issues standard mileage rates for 2024; At mileiq, we frequently get asked, “is mileage reimbursement different for electric vehicles?

Source: mileagetip.com

Source: mileagetip.com

Mileage Allowance Free Printable Mileage Log 2024 Form Printable, The irs optional standard mileage reimbursement rate will increase to 67 cents per mile driven for business use, which is. 67 cents per mile driven for business use (up 1.5 cents from.

Source: handypdf.com

Source: handypdf.com

2024 Mileage Log Fillable, Printable PDF & Forms Handypdf, 70¢ per kilometre for the first 5,000 kilometres driven; The formula for calculating mileage reimbursement for electric vehicles (evs) primarily considers the electricity cost to operate the vehicle for business purposes.

Source: projectopenletter.com

Source: projectopenletter.com

Example Mileage Reimbursement Form Printable Form, Templates and Letter, The automobile allowance rates for 2024 are: White house softens ev mileage rule in a win for automakers.

Source: www.xltemplates.org

Source: www.xltemplates.org

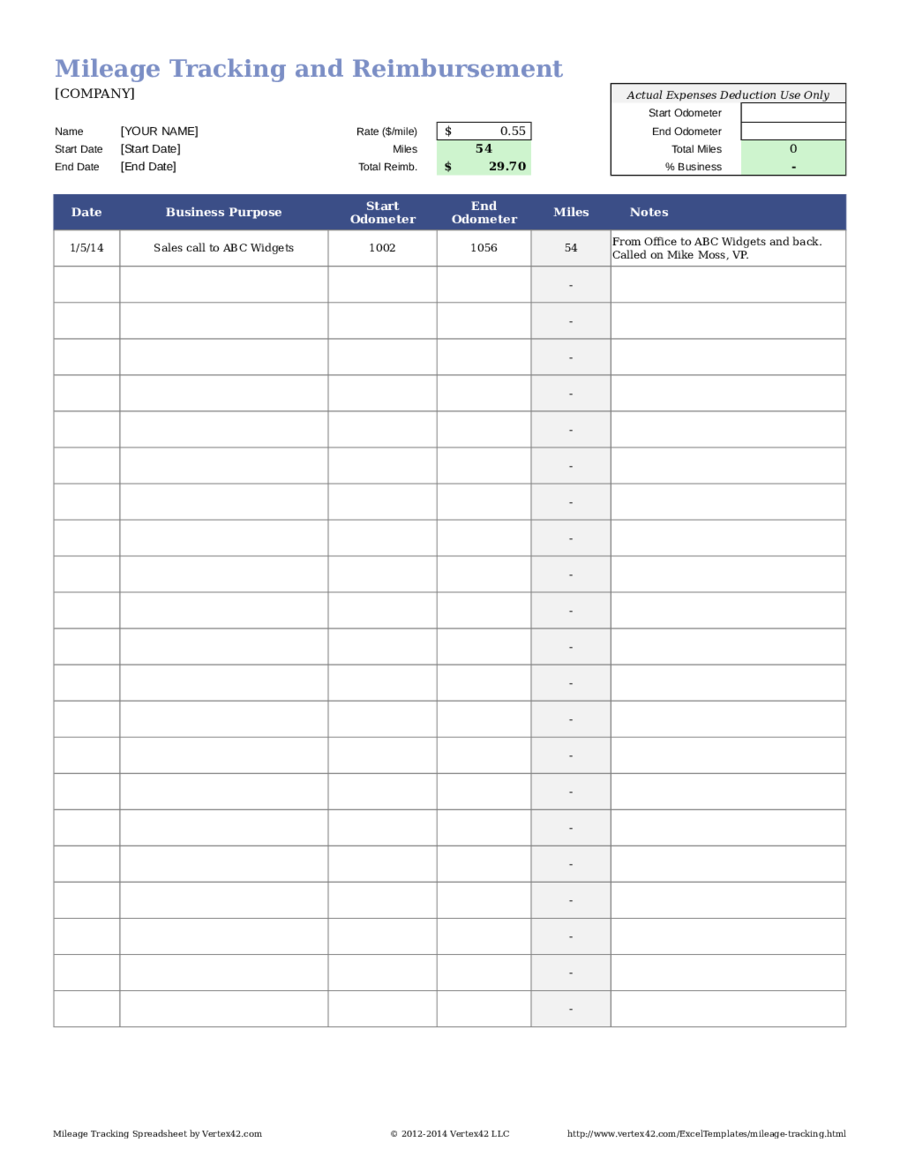

Mileage Reimbursement Form Template for Excel Excel Templates, A electric vehicle charger is seen as a vehicle charges in manhattan, new york, u.s., december. Irs issues standard mileage rates for 2024;

Source: printable.nifty.ai

Source: printable.nifty.ai

Free Mileage Reimbursement Form Template PRINTABLE TEMPLATES, 67 cents per mile driven for business use, up 1.5 cents from 2023. The 2024 hmrc electric car mileage rate is 9p for company cars.

Source: triplogmileage.com

Source: triplogmileage.com

Electric Car Mileage Reimbursement Rate Explained (2024), Irs issues standard mileage rates for 2024; March 19, 202411:40 am pdtupdated a month ago.

Source: www.printableform.net

Source: www.printableform.net

Printable Mileage Reimbursement Form Printable Form 2024, 67 cents per mile driven for business use (up 1.5 cents from. The irs optional standard mileage reimbursement rate will increase to 67 cents per mile driven for business use, which is.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

2024 & 2023 Mileage Reimbursement Calculator Internal Revenue Code, The formula for calculating mileage reimbursement for electric vehicles (evs) primarily considers the electricity cost to operate the vehicle for business purposes. The following was posted on the irs website:

The Formula For Calculating Mileage Reimbursement For Electric Vehicles (Evs) Primarily Considers The Electricity Cost To Operate The Vehicle For Business Purposes.

White house softens ev mileage rule in a win for automakers.

The Following Was Posted On The Irs Website:

Beginning on january 1, the 2024 optional standard mileage rates used to calculate the deductible costs of operating an automobile for business, charitable,.